History

Since its foundation, the Group has evolved into a pure luxury goods group. Discover our journey here.

1988

Foundation of Compagnie Financière Richemont SA

Compagnie Financière Richemont SA was founded by Johann Rupert in 1988 through the spin-off of the international assets owned by Rembrandt Group Limited of South Africa (now known as Remgro Limited). Established by Dr Anton Rupert in the 1940s, Rembrandt Group owned, in part, gold and diamond mining industries, as well as luxury goods investments, that, along with the investment in Rothmans International, would ultimately form Richemont.

1990

Establishment of Sup de Luxe

Cartier founds Sup de Lux, the reference for training in the luxury sector. This marks the luxury sectors increasing economic importance, as well as its specific codes and professional requirements.

1991

Creation of Salon International de la Haute Horlogerie

Cartier, Baume & Mercier, Piaget, Gérald Genta and Daniel Roth launch the Salon International de la Haute Horlogerie to create an exclusive watch salon based in Geneva.

1992

Foundation of the Institut Horlogerie Cartier

Cartier establishes the Institut Horlogerie Cartier (IHC) in Couvet, Switzerland to pass on exceptional watchmaking, polishing and mechanical skills to future generations. The institute also provides experienced craftsmen with a wide range of training courses, allowing them to perfect their expertise.

1992

Creation of Montblanc Cultural Foundation

The Montblanc Cultural Foundation is established, marking the inauguration of initiatives that sponsor art, contemporary art, young theatre and classical music worldwide.

1993

Separation of Richemont’s luxury goods holdings and its tobacco business

The Group’s second decade is marked by the strategic separation of Richemont’s luxury goods holdings into Vendôme Luxury Group (Vendôme), a newly-created, UK-listed group, and Richemont’s tobacco business into Rothmans International

1994

Move of La Fondation Cartier to Paris

La Fondation Cartier pour l’art contemporain moves from Jouy-en-Josas to Paris, into a sustainable glass and steel building designed by French architect Jean Nouvel

1994

Acquisition of James Purdey & Sons

Vendôme acquires James Purdey & Sons, the reference in British gun making and countryside elegance since 1814. The British gun maker is renowned for bespoke sporting shotguns and rifles, as well as luxurious clothing and accessories, having earned a royal warrant from every monarch since Queen Victoria.

1996

Acquisition of Vacheron Constantin

Vendôme strengthens its luxury portfolio by acquiring Vacheron Constantin, the oldest watch manufacturer in continuous existence, renowned for its stylistic sophistication and watchmaking excellence.

1997

Acquisition of Panerai and Lancel

Vendôme buys the Italian high-precision watchmaker, Panerai, and the French leather goods Maison, Lancel.

1998

Richemont buys out Vendôme’s minority shareholders

Richemont obtains 100% ownership of Vendôme’s luxury goods interests by buying out its minority shareholders.

1998

Buyout of Rothmans International minority shareholders

Richemont buys out Rothmans International minority shareholders and merges its tobacco interests with those held by Rembrandt Group in South Africa.

1999

Acquisition of 60% in Van Cleef & Arpels

Richemont closes the decade with the strategic acquisition of a 60% interest in Van Cleef & Arpels, one of the world's most prestigious and widely recognised jewellery houses. The same year, the Group also disposes of a 15% interest in Canal+ in exchange for 2.9% interest in Vivendi.

1999

Merger of Rothmans International and British American Tobacco

Richemont becomes a 23.3% shareholder in the enlarged British American Tobacco through the merger of Rothmans International with British American Tobacco.

1999

Merger of Richemont’s and Vendôme’s governance structures

The management and executive board structures of Richemont and Vendôme merge.

2000

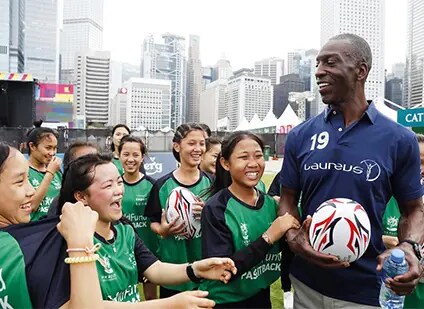

Foundation of Laureus Sport for Good

Richemont and Daimler co-found Laureus, a global organisation that celebrates sporting excellence and uses sport as a powerful and cost-effective tool to help children and young people overcome violence, discrimination and disadvantage in their lives. The unique organisation philosophises Nelson Mandela’s famous speech about sport having the power to change the world.

2000

Exit from pay-television and electronic media investments

Richemont vacates pay-television and electronic media with its sale of Vivendi. Here begins the reduction in the Group's interest in British American Tobacco.

2000

Acquisition of A. Lange & Söhne, IWC Shaffhausen and Jaeger-LeCoultre

Richemont enhances its focus on luxury goods by acquiring the three vertically integrated Swiss watchmakers, A. Lange & Söhne, IWC Shaffhausen and Jaeger-LeCoultre, renowned for technical excellence, expertise in manufacturing high value movements and unique positions in the classical segment of the luxury watch market.

2001

Increased interest in Van Cleef & Arpels

Richemont increases its interest in the French jewellery Maison, Van Cleef & Arpels, to 80%.

2002

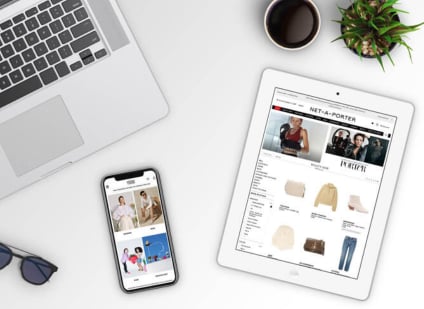

Acquisition of 30% in NET-A-PORTER

Richemont continues its pioneering into online luxury retail by acquiring a 30% stake in the two-year-old online luxury fashion retailer, NET-A-PORTER

2002

Launch of L'Institut Cartier Joaillerie

Cartier opens the L'Institut Cartier Joaillerie with the objective of maintaining and developing the jewellery arts through a continuous and tailor-made training programme. The Institute partners with specialised schools to host trainees, coach apprentices and support schools as the profession evolves.

2003

Full ownership of Van Cleef & Arpels and A. Lange & Söhne

Richemont takes full ownership of the renowned jewellery house Van Cleef & Arpels, acquiring the remaining 20% interest from minority shareholders. Additionally, Richemont acquires the remaining 10% interest in A. Lange & Söhne.

2003

Launch of Creative Academy

Richemont launches Creative Academy in Milan, a school that selects, nurtures and prepares young creative talents for the design of luxury jewellery, watches and fashion accessories.

2004

Reduced interest in British American Tobacco

Richemont’s effective interest in the ordinary share capital of British American Tobacco is diluted to 18.6% during the three-month period ending 31 March 2003.

2004

Presentation of the Montres et Merveilles exhibition

Richemont partners with The City Council of Beijing, The Chinese Watch Association and The People’s Palace of Culture, Beijing, to facilitate and partake in the first exhibition of fine watchmaking staged in the exceptional surroundings of the Forbidden City in Beijing.

2005

Establishment of the Fondation de la Haute Horlogerie

Richemont, Audemars Piguet and Girard-Perregaux establish Fondation de la Haute Horlogerie (FHH), a not-for-profit foundation that aims to promote the reputation of watchmaking excellence around the world by sharing horological knowledge and organising events for the general public and professionals. The FHH is supported by leading names in the watch industry and independent creators, all actively contributing to its activities.

2005

Foundation of the Responsible Jewellery Council

Richemont through Cartier acts as one of the 14 founding members of the Responsible Jewellery Council (RJC), established to promote responsible environmental and social practices in gold and diamond supply chains.

2006

Move of Richemont headquarters to Bellevue

Richemont's headquarters move to Bellevue, located in Switzerland’s Canton of Geneva. The headquarters are surrounded by Jean Nouvel-designed modern architecture, a breathtaking natural landscape and a 19th century chalet, reflecting the Group’s unique blend of tradition and innovation.

2006

Publication of first Group Sustainability Report

Richemont publishes its first Group Sustainability Report, as well as related codes of conduct on sustainability and the environment. In addition, the Cartier Women’s Initiative is founded to support women-run and women-owned businesses from any country and sector that aim to have a strong and sustainable social and/or environmental impact

2006

Sale of Old England

Richemont disposes of its stake in its Paris-based subsidiary, Old England SA. The sale follows Richemont’s disposal of the UK brand Hackett the year before.

2006

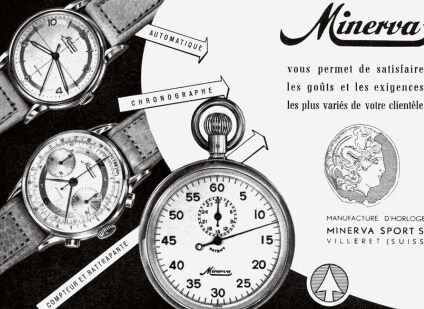

Acquisition of Fabrique d’Horlogerie Minerva and partnership with Greubel Forsey

The Group’s portfolio is once again strengthened through the acquisition of Fabrique d’Horlogerie Minerva, which specialises in the development and manufacturing of high-end mechanical movements. In the same year, Richemont establishes a long-term partnership and 20% equity stake with the innovate Swiss watchmaker, Greubel Forsey.

2007

Acquisition of Maison Alaïa

Richemont continues to focus on exemplary Maisons through the acquisition of Alaïa, the iconic Parisian Couture Maison.

2007

Creation of Manufacture Genevois de Haute Horlogerie

The strategic development of the Group’s manufacturing capabilities progresses with the purchase of the watch case manufacturer Donzé-Baume and of the component manufacturing operations of Manufacture Roger Dubuis, renamed as Manufacture Genevois de Haute Horlogerie.

2008

Regrouping of luxury businesses into Reinet Investments S.C.A

The Group focuses purely on its luxury business by regrouping its other interests into Reinet Investments S.C.A., a new, separately traded vehicle.

2008

Acquisition of 60% in Manufacture Roger Dubuis

Richemont strengthens its luxury portfolio by acquiring Roger Dubuis, the watchmaking Maison at the forefront of contemporary Haute Horlogerie.

2009

Achievement of carbon neutrality

Through purchases of carbon offsets and efforts to decrease emissions, the Group become carbon neutral across its operations, including travel, buildings, and own logistics.

2010

Strengthening of environmental commitments

The Group pledges to further protect the planet as new manufacturing facilities are designed with special care for the environment.

2010

Increase in ownership of NET-A-PORTER

Richemont extends its strategic move into online luxury retail by expanding its ownership to over 90% of the shares of NET-A-PORTER, now the premier online luxury fashion retailer.

2012

Establishment of Cartier Philanthropy

A pivotal moment in Cartier’s humanitarian journey, the Richemont Maison founds Cartier Philanthropy, aimed at improving the lives of vulnerable communities in low-income countries around the world, with a particular focus on women and children. The foundation funds non-profit organisations to create positive impacts in four key areas: Access to Basic Services, Women’s Social and Economic Development, Sustainable Livelihoods and Ecosystems, and Emergency Response.

2012

Foundation of L'École des Arts Joailliers

L'École des Arts Joailliers, the first school to share the craftsmanship secrets of the jewellery world with international audiences, opens in Paris with the support of Van Cleef & Arpels.

2012

Opening of Campus Genevois de Haute Horlogerie

The Campus Genevois de Haute Horlogerie, built in accordance with evolving environmental and social regulations, opens to transmit knowledge and expertise in watchmaking through The Ecole des Métiers et Artisans de Haute Horlogerie.

2012

Acquisition of Varin-Etampage & Varinor

Richemont acquires Varin-Etampage & Varinor, a high-end manufacturer of stamped exterior components for watches, and gold refiner and producer of semi-finished precious metal products destined for watches and jewellery. Richemont extends its manufacturing capabilities and improves control over its supply chain.

2012

Acquisition of Peter Millar

Richemont expands its womenswear and menswear offering by acquiring Peter Millar, a prestigious Maison renowned for its strength in the US market, performance golf clothing and strong online retail presence.

2013

Pioneer in Switzerland with the adoption of the Responsible Jewellery Council Codes of Practice

Richemont was a pioneer in Switzerland with the early adoption of the Responsible Jewellery Council Code of Practices, which since 2013 has been deployed in the watch industry. Today more than 95% of 18 carat gold delivered to our Maisons is delivered by RJC COP certified suppliers.

2013

Joins UN Global Compact

Richemont becomes a member of the UN Global Compact, the world’s largest corporate sustainability initiative based on CEO commitments to implement universal sustainability principles and to take action to support UN goals.

2014

Inauguration of three-year sustainability plan

Richemont reveals its three-year sustainability approach, which is set to be supported by measurable targets.

2014

Joining forces with l’École Polytechnique Fédérale de Lausanne

Richemont creates an academic chair in “Multi-scale Manufacturing Technologies” and signs a research agreement with l’École Polytechnique Fédérale de Lausanne (EPFL) to develop new technologies for the high precision industry.

2015

Foundation of the Coloured Gemstones Working Group

Richemont through Cartier and Van Cleef & Arpels cofounds the Coloured Gemstones Working Group (CGWG) alongside Tiffany & Co., Swarovski, LVMH, Kering and Gemfields. The CGWG aims to support the industry’s responsible sourcing of coloured gemstones by promoting best practices, developing tools and reducing adverse impacts throughout the supply chain.

2015

Launch of TimeVallée

Richemont establishes TimeVallée, a visionary multi-brand watch retail concept. The luxury and innovative destination store aims to benefit customers and the watch industry as a whole, opening its doors to all high-end watchmakers and available to multi-brand watch retail partners.

2015

Merger of The NET-A-PORTER GROUP with YOOX Group

In an all-share transaction, the YOOX NET-A-PORTER GROUP is created and listed on the Italian stock exchange, with Richemont initially holding 50% of the share capital and 25% of the voting rights.

2017

Sale of Shanghai Tang

Richemont completes the sale of Shanghai Tang, which it previously acquired in 2008.

2017

Acquisition of Serapian

Richemont acquires Serapian, a Maison synonymous with Italian sophistication and excellence in craftsmanship, and a one-time leather supplier to Cartier and dunhill.

2018

Richemont issues €4bn inaugural Euro denominated bond

Richemont secures Compagnie Financière Richemont an “A+” credit rating from S&P Global Ratings.

2018

Launch of Homo Faber inaugural exhibition

Homo Faber, the first major exhibition dedicated to showcase European top craftsmanship, opens in Venice with this support of the Michelangelo Foundation. The design event aims to celebrate the work of master artisans by offering the general public an unprecedented opportunity to meet the artists and discover their unique creations.

2018

Sale of Lancel

Richemont completes the sale of Lancel, a French luxury leather goods company, to Piquadro S.p.A., an Italian leather goods group listed on the Milan Stock Exchange.

2018

Full ownership of YOOX NET-A-PORTER GROUP and acquisition of Watchfinder & Co.

Richemont acquires full ownership of YOOX NET-A-PORTER GROUP, the world’s leading online luxury and fashion retailer. In the same year, Richemont acquires Watchfinder & Co., a UK leading pre-owned premium watch specialist to benefit from a complementary, growing and relatively unstructured segment of the watch industry.

2019

Launch of AZ Factory

Richemont and Alber Elbaz open AZ Factory, a pioneering joint venture focused on designing beautiful, solutions-driven fashion that works for everyone – smart fashion that cares. Resetting the way fashion typically operates, the digital luxury start-up is strongly focused on transparency, sustainability, inclusivity, and education.

2019

Launch of transformational sustainability strategy

Richemont strengthens its sustainability ambitions by progressing towards a world of ‘Better Luxury’, in which the way of creating luxury is more sustainable and responsible, leaving a positive impact on all stakeholders. The associated ‘Movement for Better Luxury’ is supported by four focus areas: People, Sourcing, Environment and Communities. In addition to being carbon neutral within its own operations, the Group will now also offset logistics emissions in Scope 3 of the GHG Protocol.

2019

Opening of NET-A-PORTER flagship store on Tmall Luxury Pavilion

The opening of NET-A-PORTER’s flagship store on Tmall Luxury Pavilion, an online platform in China for leading luxury brands, marks the operational launch of FENGMAO 风茂, the joint venture between YOOX NET-A-PORTER GROUP and Alibaba Group aimed at embracing the future of luxury in a connected world.

2019

Acquisition of Buccellati

Richemont extends its fine jewellery expertise by acquiring Buccellati, the renowned and highly distinctive Italian jewellery Maison. In the same year, Richemont signs an agreement to form an innovative join venture, AZfashion, with acclaimed designed Alber Elbaz.

2020

New digital presence on Tmall Luxury Pavilion

Cartier, Chloé, IWC, Jaeger-LeCoultre, Montblanc, Panerai, Piaget and Vacheron Constantin continue to develop their digital offers, launching online flagship stores on Alibaba’s Tmall Luxury Pavilion. This brings a unique shopping experience to Chinese clients of the exclusive platform.

2020

Participation in Digital Watches & Wonders

Together with the Fondation de la Haute Horlogerie, Richemont’s Maisons, businesses and people address the Covid-19 pandemic by facilitating and participating in the world’s first Digital Watches and Wonders. The digital exhibition created over 360m impressions and was streamed by 160 000 viewers.

2021

Acquisition of Delvaux

Richemont acquires Delvaux, the renowned Belgian and oldest luxury leather goods Maison in the world.

2022

Creation of the Watches & Wonders Geneva Foundation

Following the success of the first edition of Watches and Wonders Geneva, Richemont, Patek Philippe and Rolex establish the Watches and Wonders Geneva Foundation (WWGF) in September 2022. The mission of the Geneva-based not-for-profit is to promote watchmaking excellence through in-person and digital watch and jewellery exhibitions internationally.

2022

Opening of Montblanc Haus

Montblanc Haus, an exhibition centre dedicated to the art of writing, opens its doors to the public in Hamburg. The award-winning architectural concept explores different themes, including Montblanc’s legacy and vision, the richness and diversity of handwriting from around the world, craftsmanship and innovation, and renowned Montblanc collections.

2023

Launch of Enquirus

Richemont launches Enquirus, a neutral, global digital platform designed to help reduce watch and jewellery related crime. Open to all luxury brands, Enquirus was created in close collaboration with a wide range of partners, including watch and jewellery manufacturers, law enforcement agencies, insurance companies, the pre-owned market and clients. This trusted space allows for watch and jewellery information to be securely uploaded, searched and shared by multiple parties, while protecting customers’ identities.

2024

Acquisition of controlling stake in Gianvito Rossi

Richemont acquires a controlling stake in Gianvito Rossi, one of the world’s leading luxury shoe Maisons. Gianvito Rossi, Founder, CEO and Creative Director of the eponymous brand, will retain a stake in the company and continue to nurture and develop the Maison in partnership with Richemont. Founded in 2006 in San Mauro Pascoli and headquartered in Milan, the Maison is recognised by clients all over the world for its sophisticated designs, unique savoir-faire and impeccable quality.